On August 8th, 2025, AECORD hosted a focused online session with Mr. Gopal Gowda, CEO of Shreshta Group, is a seasoned civil engineer and MRICS member with over 30 years of global experience in real estate and infrastructure across India, the Middle East, and Southeast Asia. He leads business development, growth planning, contracts, legal affairs, marketing, and sales for the group. His career includes senior roles at Ozone Group, ASK Property Investment Advisors, and Bangalore International Airport, among others. Gopal has delivered large-scale township and mixed-use projects like Ozone Urbana (205 acres) and QVC Hills (89 acres). His leadership combines strategic vision with hands-on expertise in executing landmark developments.

Real estate continues to be one of the most reliable wealth-building avenues, but achieving strong returns requires strategic planning, market awareness, and careful decision-making. Here’s a detailed look at the key factors, strategies, and considerations every investor should know.

Factors Affecting Returns in Real Estate

The profitability of any real estate investment depends on a mix of market, economic, and property-specific factors:

Location Advantage – Prime neighbourhoods and high-demand zones consistently offer better appreciation and rental yields.

Market Demand & Supply – Balanced inventory ensures stable growth, while oversupply can slow returns.

Infrastructure Growth – Projects near upcoming transport links, educational hubs, and civic amenities enjoy higher value growth.

Economic Climate – Interest rates, inflation, and GDP growth influence buyer sentiment and price trends.

Regulatory Framework – Laws like RERA, zoning policies, and taxation can directly impact profitability.

Property Type – Residential, commercial, and mixed-use developments each have unique risk-reward profiles.

Risk Mitigation Strategies

Smart investors focus on reducing risk while maximizing potential:

Diversify Investments across property types and locations to spread exposure.

Due Diligence First – Verify title deeds, clearances, and compliance before investing.

Choose Reputed Developers with a proven track record.

Market Monitoring – Stay updated on trends and adapt strategies as needed.

Financial Safeguards – Maintain property insurance and an emergency fund for unforeseen events.

Investment Evaluation Methods

Before committing funds, evaluate a project’s potential with proven metrics:

ROI (Return on Investment) – Compares profit earned to total capital invested.

Cap Rate – Measures rental yield relative to purchase price.

NPV (Net Present Value) – Calculates today’s value of future earnings.

IRR (Internal Rate of Return) – Shows expected annualized returns over time.

Comparative Market Analysis (CMA) – Compares prices with similar properties in the area.

Architectural & Development Considerations

The design and build quality of a project directly affect its market appeal:

Efficient Design for optimal space usage.

High-Quality Materials and sustainable construction practices.

Adaptability for future layout changes or mixed-use purposes.

Compliance with building codes and green certifications.

Added Amenities that attract buyers or tenants, such as gyms, co-working spaces, or landscaped gardens.

Market Timing & Cycles

Understanding the property cycle is essential for maximizing returns:

Recovery Phase – Best entry point; prices are low, and demand begins to rise.

Expansion Phase – Strong growth in prices and demand; ideal for selling or leasing.

Hyper-Supply – Excess inventory may slow growth; invest cautiously.

Recession Phase – Prices and demand drop; focus on holding and long-term value.

Expert-Led Q&A Sessions

Q: Which one of the costs you mentioned in the sheet will give a better IRR? Which one is more prominent?

A: IRR is influenced by the combination of land cost, construction cost, and sales price. While every component matters, controlling construction cost without reducing quality often impacts IRR most directly. In high land-price areas, securing land at a better rate can also significantly enhance returns. The priority depends on project type and market conditions.

Q: When should an investor enter the real estate market to maximize returns?

A: The best entry point is often during the early stages of a market cycle when land values are stable, demand indicators are rising, and competition is still moderate. This allows investors to benefit from appreciation over the construction period while avoiding peak-price risks.

Q: How can risks be reduced in real estate development projects?

A: Effective risk mitigation includes thorough due diligence, securing clear legal titles, accurate cost estimation, diversifying funding sources, and having contingency plans for delays. Partnering with experienced consultants and monitoring market trends are also crucial.

Q: What architectural considerations can help improve project returns?

A: Designing efficient layouts that maximize usable space, selecting cost-effective but durable materials, and incorporating sustainable design elements can attract buyers and tenants, leading to higher sales velocity and better pricing.

https://shreshtagroup.com/team-details_gopal.html

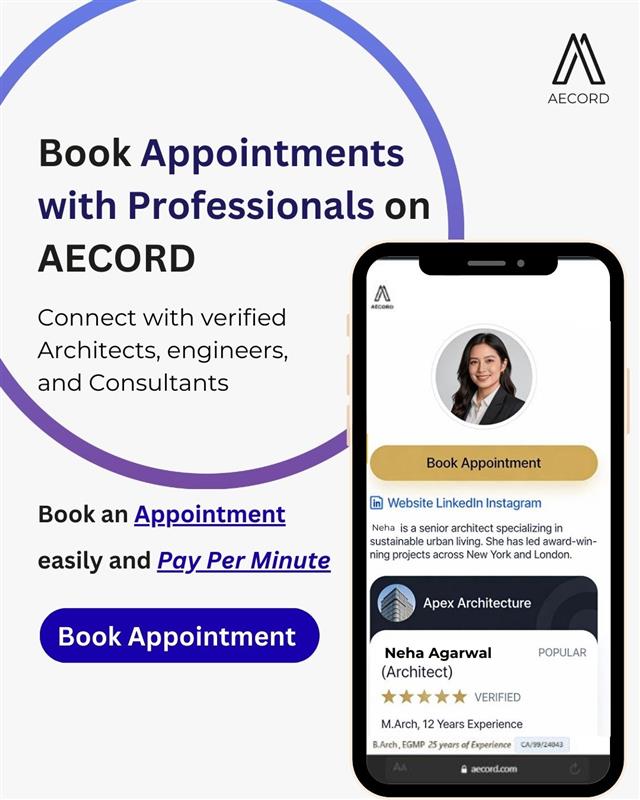

Professional Onboarding

https://aecord.com/consultants/

For a more detailed explanation and full insights, the complete video of this session will be available on our YouTube channel — [AECORD]. We invite you to visit, watch, and subscribe for more expert-led content.